Contents

If you prefer to https://topforexnews.org/ securities for several weeks or months, you could be a “position trader.” These shareholders set aside substantial amounts of money for investment purposes. These traders usually make the most money when their stocks trend upward for several hours. Scalpers mostly use price action to find entry and exit positions. Price action is the process of identifying patterns and predicting the next moves.

As a provider of educational courses, we do not have access to the personal trading accounts or brokerage statements of our customers. As a result, we have no reason to believe our customers perform better or worse than traders as a whole. Ross Cameron’s experience with trading is not typical, nor is the experience of traders featured in testimonials. Becoming an experienced trader takes hard work, dedication and a significant amount of time. This high level of downside momentum can indicate that the selling isn’t over yet, so it doesn’t make sense to institute a long position yet. As you can see below, /ES was in an uptrend, and then sold-off heavily in late July, only to find support around $2840.

Breakout trading is an approach where you take a position on the early side of an UPTREND, and looking for the price to“breakout”. You enter into a position as soon as price breaks a key level of RESISTANCE. If it’s a retracement, price moving in against the primary trend should be temporary and relatively brief. Retracement trading involves looking for a price to temporarily reverse within a larger trend.

In scalping, traders monitor the tick chart or the 1 to 5 minute chart, whereas swing traders track daily and weekly charts. It is a solid basis of price action for buying or selling securities for traders. Volume discloses the actual strength of the ongoing trend of a security.

Sideways market

These indicators reveal the market trend, momentum, and trading volume of securities. And while trading may present an opportunity for attractive returns in the short term, buying and holding is the surest way to beat the market and achieve your financial goals. If you have a low risk tolerance, or if you don’t have sufficient risk capital, then you might want to avoid it altogether. But if you have the tolerance, risk capital, and willingness to learn to swing trade, you might find it a valuable skill that could potentially supplement your longer-term investments. Most traders prefer using the Japanese candlestick charts since they are easier to understand and interpret.

For example, if you take a long position , you will want to see a reasonably priced valuation, strong earnings, and a healthy balance sheet. As for technical analysis, you can identify opportunities by using support and resistance levels and indicators that show volume and momentum. Swing trading is more accessible than day trading and does not require special tools; it lets traders avoid PDT rules and restrictions while making profits. But with that said, swing traders generally take on more risk than long term investors. When opening a position in a stock, you are expecting to capitalize on a short term upswing – but it doesn’t always pan out that way.

What Percentage of Swing Traders Make Money & Are “Successful”?

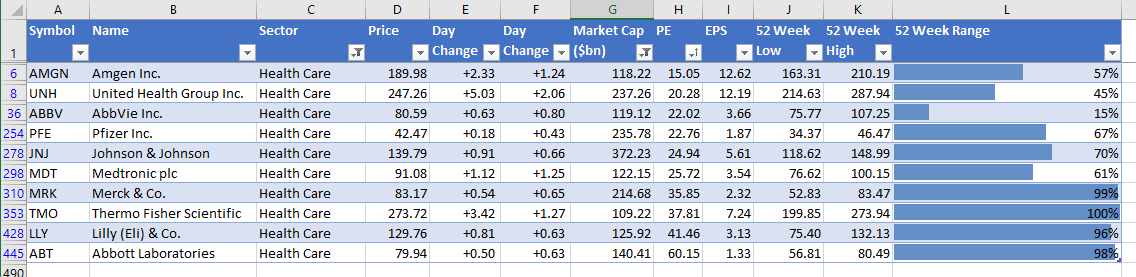

Producing a wide range of equipment, Caterpillar encompasses four business segments, including construction industries, resource industries, energy and transportation, and financial products. The company’s stocks show high liquidity, with over 2 million shares traded daily. Price ChangePrice change in finance is the difference between the initial and final values of an asset, security, or commodity over a particular trading period.

Keep in mind that the vast majority of traders treat it more like gambling. They don’t actually use software to help them make emotionless decisions, they don’t follow sound strategies or principles, and they don’t have the right mindset. In this article, we’re going to address these two questions and evaluate the average swing trading success rate as a whole.

Moving averages

One of the most prominent features is that swing trading can be applied both for bull and bear markets. However, traders should remember that swing trading also comes with certain financial risks. Seeing a good success rate with swing trading is entirely feasible and actually quite simple. You just need to keep your losses infrequent & small and take profits when you can. With that said, there are a few things you can do to dramatically improve your chances of being among the 10% or so of swing traders who consistently earn profits over the course of a year.

Without a doubt, swing trading offers better returns – both in terms of profit and time. You may earn less profit percentage per swing trade compared to investing – that much is true. Swing traders are content with 5-10% profits per trade, whereas long term investors can earn upwards of 25%, 50%, 200% – you get the point. Swing traders may track trends in performance, momentum or volume. Some indicators used in swing trading include relative strength index, moving average, trading volume, and Bollinger band.

- Penny stocks present an appealing opportunity to buy when a stock trades for a low value in the hopes of making quick money when it moves up suddenly.

- Swing trading refers to the practice of trying to profit from market swings of a minimum of 1 day and as long as several weeks.

- But to summarize, this strategy entails capitalizing on short-term or midterm swings in a stock or commodities price.

- Support LevelSupport level refers to a point in the securities trading below which the price of the security does not fall.

- Because their trades take days to unfold, they aren’t required to sit at their screens, watching each tick go by.

- Forex, stocks, and futures all require different amounts of capital to start with.

Day traders are also more likely to manage several positions throughout the day, while swing traders might have only a few positions that they track for days or weeks. Missing out on just a few key days can have a major impact on your investment returns over time. Picking stocks for swing trading will involve a mixture of fundamental analysis and technical analysis. Fundamentally, you want stocks to exhibit certain traits based on the position you are taking.

Swing traders leverage technical analysis to determine entry and exit points. In today’s fast, news-driven environment, it is easy for investors to get caught up in news that can rattle markets. Whether it is legit news or fake news, it has the same effect—it is unnerving and can cause emotional angst. Investors can manage their emotions during market swings by having an investment plan. During times of uncertainty, following a plan helps investors remain calm and ride out the swing. Day traders execute short and long trades to capitalize on intraday market price action, which result from temporary supply and demand inefficiencies.

Benzinga Pro (Best for Fast Actionable Market News and Research)

https://en.forexbrokerslist.site/ requirements vary for day traders and swing traders, depending on whether they trade the stock, forex, or futures markets. Fundamental analysis doesn’t hold much weight, as swing traders aren’t concerned with the long-term picture of a stock they’re swing trading. And, these returns come quickly because swing traders enter and exit their position in as little as a few days. As such, you can make swing trading a great source of secondary – or perhaps even primary – income.

What are the Best Swing Trade Alerts Services?

In contrast, swing traders attempt to trade larger market swings within a more extended time frame and price range. Larger price action within a span of days or weeks can often be sensitive to investor response toward fundamental developments. Hence, swing traders rely on technical setups to execute a more fundamental-driven outlook. If you’re new to technical analysis, you might want to review the basics. Swing trading and day trading have many similarities, but the most marked difference is the frequency of trades. Swing traders focus on short-to-medium term positions while day traders close out their positions at the end of each trading day.

Meanwhile, swing traders have to be wary that a stock could open significantly different from how it closed the day before. While a swing trader can enjoy success in any number of securities, the best candidates tend to be large-cap stocks, which are among the most actively traded stocks on the major exchanges. Swing trades are also viable in actively traded commodities and forex markets.

Find similar words to short-swing stock trade using the buttons below. Day trading stocks in the U.S. requires an account balance of at least $25,000. Before you begin, take advantage of paper trading, which is the process of making hypothetical trades as if you were trading real funds.

You can prepare for your future by investing in long term plays while earning income through swing trading. This will allow you to enjoy the best of both worlds while diversifying your investment strategy. Generally, this is a style of investing done by those who are looking to set themselves up for retirement. With that said, you may close your positions on a long term investment once you’re satisfied with the profit – sometimes just a year after opening your position.

The gains might be smaller, but done consistently over time they can compound into excellent annual returns. Swing Trading positions are usually held a few days to a couple of weeks, but can be held longer. Much of the seemingly “random walk” of prices from minute to minute throughout the day may appear as noise. Most swing traders use daily charts (like 60 minutes, 24 hours, 48 hours, etc.) to choose the best entry or exit point. However, some may use shorter time frame charts, such as 4-hour or hourly charts.

Both trading styles can net you gains, but they depend on the amount of capital available, how much time you have, your trading psychology, and the market you’re trading. With a proper strategy, Starbucks stocks can make for profitable swing trade. The company showed some breath-taking results last year, becoming a nearly $3 trillion company in December 2021.

You can also open a demo account if you would like to practice the above swing trading strategies in a risk-free environment. Like RSI, the method can identify the various overbought or oversold zones. Here, the level beyond 80 is the overbought zone, and the level below 20 is the oversold zone. Nevertheless, these zones can be a gamechanger for swing traders as they can know the point of the reverse of the trend.

Some of the more common https://forex-trend.net/ involve moving average crossovers, cup-and-handle patterns, head and shoulders patterns, flags, and triangles. Key reversal candlesticks may be used in addition to other indicators to devise a solid trading plan. The goal of swing trading is to capture a chunk of a potential price move. While some traders seek out volatile stocks with lots of movement, others may prefer more sedate stocks.

.jpeg)

.jpeg)

.jpeg)