Contents:

Checkout something like Gusto, especially if you’re aiming for streamlined payroll without fuss and bother. So important is security to Intuit that it actually has an entire security center, dedicated to keeping the entire product suite and its customers safe and secure. Intuit invests lots of money in ensuring its systems have multiple layers of security. Dealing with normally stressful matters such as payroll is nowhere near as complicated as it used to be, but Intuit makes the job even simpler. We spend hours testing every product or service we review, so you can be sure you’re buying the best.

You can now try to do it all over again. We hope that you’ll be able to print your 1099 form successfully this time. Click on Privacy and then on Content settings. Check for Open PDF files in the default PDF viewer application.

Here is a average collection period formula of our partners and here’s how we make money. They are made of thick material with a security tint inside, making it almost impossible to read information through the envelope. The 1099 envelopes come with a sign Important Tax Document Enclosed, which guarantees they would be delivered faster than regular mail. Form 1099 contains confidential information about your company as well as third parties.

Intuit,

On this document, they also indicate whether their business is a sole proprietorship, corporation or some other entity. Even though vendors are required to provide a W-9 when asked, many hesitate to do so after they have been paid. For this reason, we recommend never paying a vendor until you have their correctly completed W-9 on file. Fortunately, it’s easy to add vendors to the contractors list on the fly. Click on the “Add from Vendor List” button and select any vendors who should be given a 1099.

The Top Construction Payroll Software of 2023 – TechRepublic

The Top Construction Payroll Software of 2023.

Posted: Fri, 14 Apr 2023 07:00:00 GMT [source]

Even though modern tools such as QuickBooks exist, you’re still responsible for your data. It’s a very sensitive topic, and we advise you to check your information carefully. Also, don’t forget first to print the sample version first to make sure everything is as it should be. It doesn’t matter whether your company paid them for their services or it was rent or some kind of reward. You need to include everything on a 1099 form.

Double-check the form you want to print and selectView selected 1099 contractorsto confirm your contractors. Purchase your 1099 Kit by mid-January so you can print. You’ll want to print and mail in time for IRS filing and contractor delivery deadlines. Form 1096 isn’t available on this tab.

Do you need to file a 1099?

No forms, no software, no mailing, no hassles. In the rare moments he’s not working he’s usually out and about on one of numerous e-bikes in his collection. The combination allows you to do a little bit of everything, which is exactly what business owners are looking for in these challenging times. You can follow the steps shared byCandice Cto get in touch with our support. QuickBooks will let you see your list of 1099 contractors that were paid below the threshold ($600).

A step-by-step process for printing 1099s in QuickBooks Online and a definition of 1099s and why they’re important. On the other hand, if the alignment is off, you should click on It doesn’t line up. You’ll then have a chance to correct it yourself. You can move it both vertically and horizontally, whatever you need.

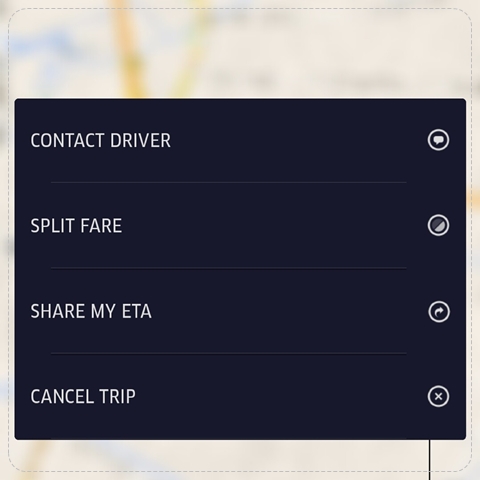

Intuit Quickbooks Payroll: Interface and in-use

Either follow the on-screen instructions or press Back until you’re on Step 4, depending on where you left off. If you’re self-employed, you’re responsible for tracking your own income. It’s easy to make unintentional errors. QuickBooks Live Bookkeeping is not included in the QuickBooks Offer. After preparing your 1099s, select the E-File option and verify your 1099s. Go to Vendors, then select 1099 Forms, then Print/E-file 1099 Forms.

- However, only those who meet the threshold will have a 1099 form.

- This service will e-file your 1099 forms directly with the IRS, and will also send copies to contractors.

- If any boxes are gray, they are mapped to the other 1099 form.

- If you are filing electronically, Form 1096 isn’t required by the IRS.

- Customers can use the support hub as their first port of call for everyday questions.

- If you have any problems, we will replace the product or refund your money.

For more info see this Tax1099 article What is the filing cut off time to be ‘on-time’. Check if the forms align properly by selectingPrint sample on blank paper. If it looks good, chooseYes, looks good! If the alignment is not correct, chooseNo, it doesn’t line upand follow the on-screen instructions to fix your alignment, then selectNext.

Intuit Quickbooks Payroll: Support

Consult your Tax Professional or IRS for the best way to report adjustments. The American Rescue Plan of 2021 changed the reporting threshold. Intuit must now report transactions paid in 2022 that exceed $600 in aggregate payments, no matter how many transactions were made. However, on December 23, 2022, the IRS delayed the implementation of the new $600 reporting threshold. Available if setup for the company is complete.

As soon as you get Form W-9 from your vendor, enter the information into their vendor profile in QuickBooks Online. This will save you from having to hunt down their information in January when the 1099 filing deadline is looming. You’ll notice there are no payments listed on this screen.

Oceanside Sanitation District is an open book during audit – liherald.com

Oceanside Sanitation District is an open book during audit.

Posted: Fri, 31 Mar 2023 07:00:00 GMT [source]

After you prepare your forms, you’ll choose to file them online or print and mail them to the IRS. Likewise, you’ll also choose if you want to email copies to your contractors or mail them printed 1099 copies. However, you can’t report electronic payments this way. It means that you don’t have to make 1099 forms for payments made using credit cards or online payment services such as PayPal.

These steps walk you through organizing your contractors and payments so your filings are correct. 1099s are the tax forms you need to file with the IRS when you pay contractors in cash, check, or direct deposit. See What is a 1099 and do I need to file one? Filing 1099 & W2 forms online simplifies the entire process for businesses and bookkeepers, eliminating the time-consuming process of printing and mailing forms.

- You’ll then have a chance to correct it yourself.

- I know the importance of having the 1099s for your vendors.

- We are ALL looking for an easy way to access 1099’s we’ve already completed, paid for, and SHOULD be able to have access to.

- You can also check your filing status anytime in QuickBooks Online.

- A version of this article was first published on Fundera, a subsidiary of NerdWallet.

- Additional fees may apply to direct deposit for contractors.

But instead of printing the real one, click on the Print sample option. That way, you’re going to see whether it is aligned as it should be or not. Filing your taxes at the end of the year is one of the most challenging tasks for all small business owners. Thankfully, today you have accounting software to help us out. QuickBooks can be super helpful here, as it is user-friendly and pretty self-explanatory.

When complete, choose theI’ll file myselfoption. If you don’t see the archived or previously filed 1099, contact us to get a copy. You did not pay them for tangible goods, unless those goods were used as part of a service the vendor delivered. You probably noticed we were doing a lot of editing on the fly as we were walking you through the process for how to print 1099s in QuickBooks Online. There are several things you can do to prevent this and make your 1099 process even easier. Software compatibility is guaranteed!

I can look at the contractors individually and see there payments but he system will not produce W2s or bring them up in a 1099 report. Find help articles, video tutorials, and connect with other businesses in our online community. 1099s and W-2s are the tax forms employers use to report wages and taxes withheld for different workers. 1099s are e-filed only for the current filing year and for payments recorded in the system. Pay your whole team, e-file 1099s, get payroll taxes done for you, and offer employee benefits with QuickBooks Payroll. If you need to file 1099s with your state, enter the information under the appropriate state boxes.

2023 Readers’ Choice Awards – The Readers Have Voted! – CPAPracticeAdvisor.com

2023 Readers’ Choice Awards – The Readers Have Voted!.

Posted: Mon, 17 Apr 2023 18:39:15 GMT [source]

Sometimes your web browser can cause your printer not to print your 1099 forms correctly. Intuit recommends using Google Chrome or Mozilla Firefox. If printing still doesn’t work on these recommended browsers, try these steps. If you don’t e-file with Intuit, you’ll need to file yourself. You must file 1099s with the IRS and in some cases your state.