Dining table of Contents

- What is actually Guarantee?

- Kind of Loans That require Equity

- SBA Loans

- Automotive loans

- Devices Fund

- Bringing Business loans Without Collateral

- Faq’s

- Obtain the Funds You ought to Launch

The web site was backed by all of our profiles. I possibly earn user hyperlinks once you click on through new associate hyperlinks on the our web site

While some options allows you to secure which have lowest startup can cost you, adopting the your own passions can sometimes require way more financial support.

Whether or not you need to obtain to build your own inventory, hire skill, otherwise book a workplace, continue reading to understand exactly what guarantee are and just how it can affect your business.

What exactly is Security?

Guarantee are a secured asset or possessions you possess that you pledge to incorporate their bank in case that you will be incapable of pay back the loan.

They essentially serves as a back up, which means that your bank won’t be left that have little should your team goes wrong otherwise you’re or even not able to generate called for money.

Organizations can get take on specific variety of guarantee and can most likely are the necessary property value this new collateral in your deal.

- A residential property, and additionally house and office buildings

After all, how come you may be obtaining a loan could be because you want to begin a corporate without currency or not adequate currency to invest.

Immediately after a debtor pledges guarantee, a lender normally seize that investment following debtor defaults into the financing of the destroyed fee episodes or perhaps not fully paying off just after a given time frame.

That said, make sure that you might be purchased trying to repay lent loans or ready to help you chance an essential asset otherwise possessions one which just enter a good loan contract.

Type of Money That need Collateral

Guarantee affects a multitude of finance, at home mortgages to secured finance, in this area, we shall work with a few brand of business loans that want this kind of insurance rates.

SBA Loans

This is because you might possibly sign up for millions, according to your position and you can projected capability to pay-off the mortgage.

SBA fund are provided because of the financial institutions, nonprofits, and other loan providers, however they are secured because of the SBA, and therefore demands collateral to be sure their money is secure.

Yet not, the new SBA rarely expects one to pay back everything in an initial time frame, so your business gets a fairly extended safety net just before collateral will be grabbed.

Automobile financing

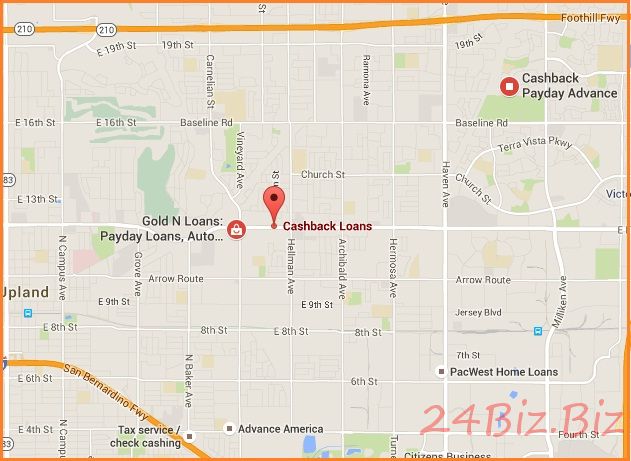

Car and truck loans try technically a kind of financing getting customers, but we’ve got incorporated this category about list from the go up from ridesharing gigs.

Uber drivers and you will Lyft drivers traditionally have fun with their own auto to help you push guests in the city, so you must receive a personal vehicle one which just normally secure.

Automobile financing are a good choice for some one trying to become another contractor for an effective rideshare organization, since might deliver the funds you prefer for your greatest startup prices.

Along with your automobile bought, you can start generating whenever you as well as your automobile is actually acknowledged for the chose platform.

If you opt to pull out a car loan, the auto you utilize the amount of money to order constantly gets your collateral.

Devices Loans

Although not, remember that interest levels shall be quite  high when the you expect their bought products getting dated quickly.

high when the you expect their bought products getting dated quickly.

Getting Loans Versus Security

But not, unsecured loans that do not require any style out-of equity carry out exists. One of the most popular samples of a personal bank loan are a student-based loan.

Many loan providers stop giving away personal loans so you can team people, there are numerous that you could be eligible for.

Although not, even in the event your simple business loan doesn’t require equity, it’s also possible to envision taking it a form of goodwill.

Additionally, when you have bad credit or was a decreased-money applicant, equity can be alter your possibility of bringing approved for a financial loan.

Faq’s

Wisdom what equity is will assist you to improve better team conclusion you can, specially when you’re taking aside a massive amount of cash when you look at the financing.

However, should your organization has actually attained adequate possessions to do something as security, you could potentially offer organization-owned guarantee to cease delivering such things as your property eliminated on bad circumstances condition.

To possess financing that especially make it easier to get company property, such as for instance gizmos financing, those assets usually each other getting owned by your online business and work since your collateral.

Within the software process, your personal credit history usually typically be affected while you are becoming felt to own last approval.

As a result your credit score wouldn’t bring a bump if you are only requesting a bid, or if you’ve obtained pre-recognition for a loan.

Although not, while serious about taking out a loan, very loan providers can do a hard query that impact the credit history.

In the event that your business is incapable of pay-off brand new financing, your credit score won’t make significant strike.

If you’ve considered otherwise took away finance just before, you have heard about the term “private verify” since the a necessity unlike security.

An individual guarantee is actually a composed pledge that you will be physically responsible for debt if the company is unable to pay straight back financing.

You are able to typically pick collateral because the a necessity after you found otherwise submit an application for higher-costs finance, as the chance try diminished when the a lender understands just what possessions you have got to secure the financing.

Get the Fund You will want to Release

Brett Helling is the maker out of Gigworker. He’s already been good rideshare rider given that very early 2012, which have accomplished countless trips getting businesses together with Uber, Lyft, and Postmates.

From the time, he’s got longer their knowledge into Gigworker website, together with creating the ebook Gigworker: Independent Really works plus the County of your own Concert Savings Soft-cover, currently available to your Auction web sites.